Semrush: Navigating the Marriage of AI and Search

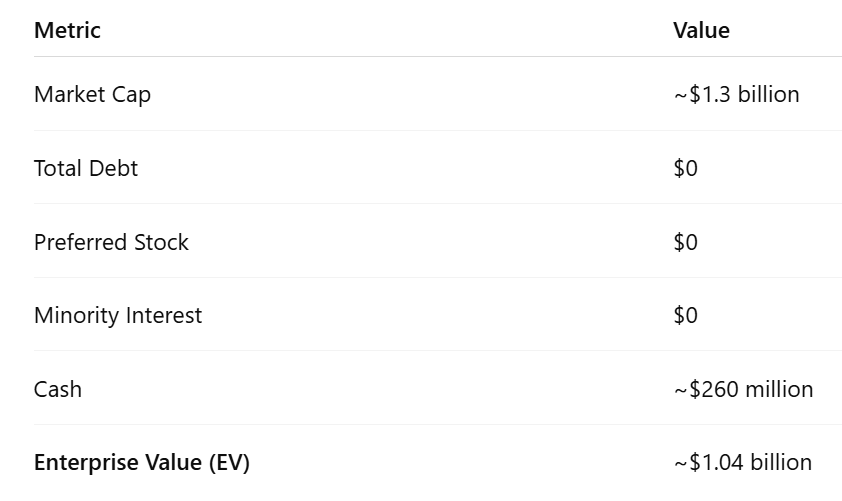

Semrush currently trades at approximately 3x revenue and holds around $260 million in cash, a substantial portion of its $1.3 billion market capitalization. This valuation stands out compared to other software peers, which often trade at 4–6x revenue, and in some cases 10–20x for companies with exceptional growth.

With a track record of 20%+ annual revenue growth and consistent product innovation, Semrush is an above-average software business. In my view, it deserves a valuation more in line with its peers. Based on this, I estimate fair value at roughly $18 per share, which is more than double the current price. As of July 15, shares closed at $8.68.

Overview and Market Sentiment

Semrush has historically been a leader in SEO (Search Engine Optimization), serving both professionals and business owners looking to improve their visibility across online search channels, including Google, Bing, and social platforms.

Recently, market sentiment has likely been impacted by the rise of AI-powered answer engines like ChatGPT, which pose a perceived threat to traditional search. However, I believe these concerns are overstated. While the search landscape is evolving, search algorithms remain foundational to how vast troves of online information are ranked and accessed. Even AI-forward tools like Perplexity blend traditional search with AI summarization. Products such as ChatGPT still rely heavily on web search to ground factual responses.

Looking ahead, AI language models will likely be scrutinized and optimized for, just as search engines were. Marketers will study their behavior, test prompts, and refine content strategies to influence how brands are represented in AI responses. This makes digital visibility even more complex, and heightens the value of tools like Semrush.

Importantly, Semrush has embraced this new paradigm. The company has launched an AI Toolkit and continues to invest in new capabilities that respond to the changing nature of online discovery.

Product Expansion and Execution

Semrush’s recent cadence of product development has been impressive. The company continues to roll out Enterprise features, including the Enterprise SEO offering launched in 2024 and the AI Toolkit launched in Q1 2025.

Management was bullish on the Q1 2025 earnings call, expressing confidence in both the pace of product launches and the early traction of key new offerings, particularly Enterprise SEO, which is already proving to be a high-margin, high-retention product.

Enterprise SEO

Launched outside beta in 2024, Semrush’s Enterprise SEO product reached an $11 million ARR (annual revenue run rate) as of Q1 2025. Management projects this will triple to $30 million by the end of fiscal 2025.

Enterprise clients spend an average of $60,000 annually, significantly above the company-wide average, and retention in this segment is also well above average. If management delivers on this guidance and continues scaling Enterprise SEO through 2026 and beyond, the product could become a meaningful contributor to total revenue growth.

At its core, Semrush’s Enterprise SEO is a feature-rich evolution of the company’s core platform, designed to support SEO teams at large enterprises. For many organizations, it presents a compelling opportunity to consolidate a patchwork of tools into a single, integrated platform—one purpose-built for reporting, collaboration, and operational efficiency.

Here are the key features from Semrush’s product launch:

AI-Powered Automation: Streamlines manual tasks, conducts technical audits, and enables real-time diagnostics using tools like the “What Has Happened?” report.

Personalized Reporting: Enables custom A/B testing, forecasting, and segmented reporting across business units to support executive communication.

Content Optimization: Offers AI-driven content analysis, multilingual support, and real-time collaboration tools to accelerate campaign workflows.

Expert Network Access: Provides on-demand access to Semrush-vetted professionals in mobile SEO, link building, keyword research, and more.

AI Toolkit

Semrush’s AI Toolkit, launched in Q1 2025, has already surpassed $4 million in ARR, making it the fastest-scaling product in the company’s history.

As the influence of LLM-based search grows, this toolkit is positioned to become a core part of brand visibility strategy. It allows businesses to track and refine how they appear in AI-generated responses across platforms like ChatGPT, Gemini, and Perplexity.

Key features include:

AI Market Share Tracking – Measures how often a brand appears in AI-generated search results and benchmarks it against competitors.

Sentiment & Brand Perception Analysis – Tracks how AI platforms describe the business, key themes in the responses, and sentiment shifts over time.

Strategic Recommendations – Uses AI-driven insights to refine go-to-market strategy and improve competitive positioning.

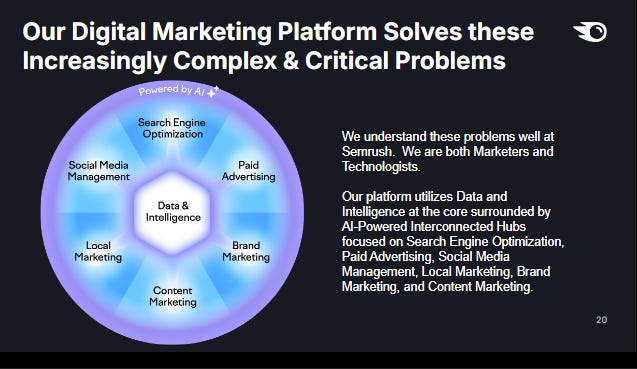

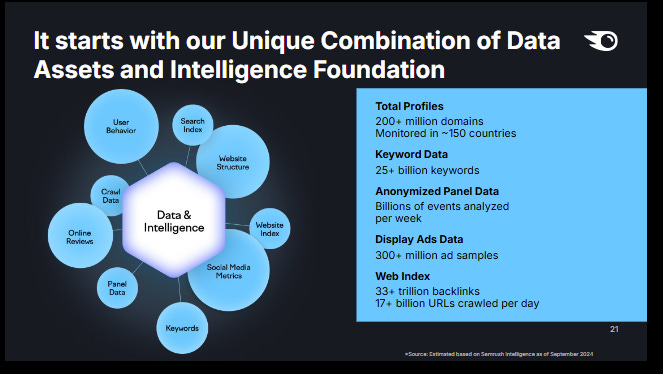

Semrush’s Data and Platform Advantage

Semrush’s Q1 2025 investor presentation does an excellent job of highlighting how data forms the foundation for a multi-product suite that now expands well beyond traditional SEO.

Balance Sheet

Final Thoughts

Semrush has already proven its ability to launch, scale, and monetize new products, and the success of both the Enterprise SEO and AI Toolkit offerings speaks to excellent execution. Management expects additional launches over the remainder of 2025, which could further accelerate revenue growth and drive multiple expansion in 2026.

Given its valuation, cash reserves, and product momentum, I believe the company is materially undervalued. My estimated fair value remains north of $18 per share.

I am bullish on Semrush.

Disclaimer:

I am not a financial advisor. This publication reflects my personal opinions and is intended for informational and educational purposes only. It should not be construed as investment advice or a recommendation to buy or sell any securities. I may hold positions in the securities discussed, but I am under no obligation to disclose current holdings, past transactions, or any future plans. Always do your own research and consult a licensed financial advisor before making any investment decisions.